SP500 LDN TRADING UPDATE 13/11/25

SP500 LDN TRADING UPDATE 13/11/25

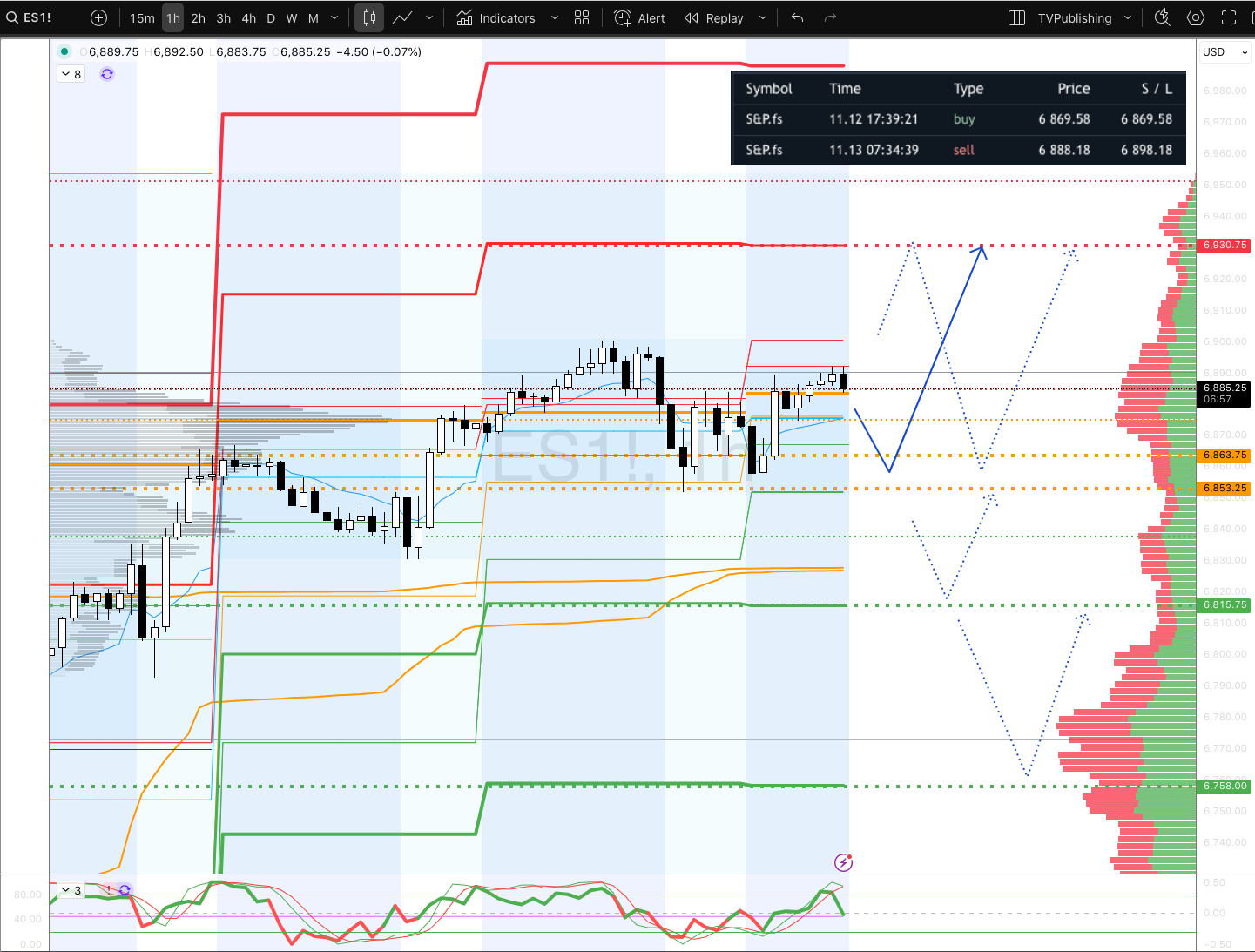

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6820/30

WEEKLY RANGE RES 6877/6629

NOV EOM STRADDLE 7054/6626

NOV MOPEX STRADDLE 6929/6399

DEC QOPEX STRADDLE 7054/6303

DAILY STRUCTURE – ONE TIME FRAMING HIGHER - 6852

DAILY BULL BEAR ZONE 6863/53

DAILY RANGE RES 6931 SUP 6814

2 SIGMA RES 6988 SUP 6758

DAILY VWAP BULLISH 6799

VIX BULL BEAR ZONE 18.5

TRADES & TARGETS

LONG ON ON TEST/REJECT DAILY BULL BEAR ZONE TARGET 6929>DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: ROTATIONAL

S&P + 6 bps closing at 6,850 with a market cap of $2.5 billion. NDIX - 6 bps at 25,517. R2K - 30 bps at 2,450 and Dow + 68 bps at 48,254.1. Total shares traded across all U.S. equity exchanges averaged 17.3 billion shares. VIX + 133 bps at 17.51, WTI crude - 434 bps at $58.39, US 10 Year - 5 bps at 4.06%, gold + 207 bps at $4,201, and Bitcoin - 75 bps at $101,836k. Dully, the tech sector (GSX1 MEGA) underperformed the NDIX by approximately 110 bps, registering the largest spreads since August. Outside of tech, the broader global equity backdrop appears promising (SX5E/7E, Brazil, UKX, Dow). Perhaps this indicates an overall broad rotation in the global economy, which seems to be in decent shape (with solid earnings revisions), while AI narratives are deemed risky. Yesterday marked only the 4th time this year that NVDA dropped 2% as SPX rose. It's worth noting that SMH posted a new record with $1.3 billion in inflows last week. This easily surpasses the previous high of $1.2 billion seen in Q1 2022. After Hours: CSCO + 3.5% on solid beats/raises regarding Product Order momentum (stock rose +3% today into print). Remarkable outperformers included 1) US Healthcare, the top-performing sector (also noted as the 'correlation hedged' to AI underperformance), valuations are attractive, and demand continues to increase; 2) Retail Group, which appears to be as simple as when QQQ underperforms (2nd day), Consumer stocks perform well. Also, ONON up +20%, a leading consumer name to report strong results and maintain momentum. Our floor rated 5 on a 1-10 scale for overall activity levels. Our floor finished +254 bps to buy versus a 30-day average of -142 bps. Institutional activity remains on the quieter side. LO's finished +$600 million net buyers driven by demand in healthcare and tech, partially offset by supply in consumer services. HF flows were roughly flat with supply in tech versus demand in energy and healthcare. DERIVS: In the vols space, flows were generally quiet on the day. The desk noted that despite the zero realized move, we did see vols slightly higher across the term structure. In our opinion, this is due to positioning and investor sentiment as we may see an NFP print next week. The desk still sees forward vol remain a buy, and we have witnessed flows to that effect. Additionally, we generally think Russell Gamma looks relatively cheap compared to the RUT, which is trading at 86 bps and resides in the 8th percentile on a 1-year look back

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!