2022年11月22日——指数观点

股市涨势因美联储鹰派而暂停

对于基准全球股票指数而言,本周开局相当平淡。在我们看到美国 10 月 CPI 报告后风险偏好有所改善的浪潮背后,由于美国零售销售好于预期、美联储鹰派评论以及对中国封锁风险的新担忧,市场失去了光彩。

作为对美联储近期评论的回应,市场对美联储 12 月大幅加息的预期再次攀升。上周,我们听到美联储的戴利呼吁美联储将利率提高到当前预期的峰值之上。本周,美联储的梅斯特回应了这种情绪,称美联储的政策需要更具限制性,并且美联储迄今为止“几乎没有”利率。如果最近的主题继续下去,特别是如果我们在下一份通胀报告中看到任何意外的上涨,股市很可能会再次走低。

中国封锁的恐惧

在中国方面,本周有消息称北京有两人因新冠肺炎死亡,引发人们担心该地区可能会面临新的封锁。由于中国目前仍坚持其零新冠病毒政策,因此确实存在宣布此类措施的风险,尤其是在发现有更多死亡病例的情况下。由于最近市场非常关注中国可能重新开放,此类消息可能会加剧股市大幅下跌,反映出失望情绪。

技术观点

达克斯指数

从年初至今的高点突破看跌趋势线目前仍在继续。价格目前位于 14170.79 上方,MACD 和 RSI 均看涨,关注点继续走高至下一个 14703.98 水平。不利的一面是,13672.31 是需要注意的重要支撑。

.png)

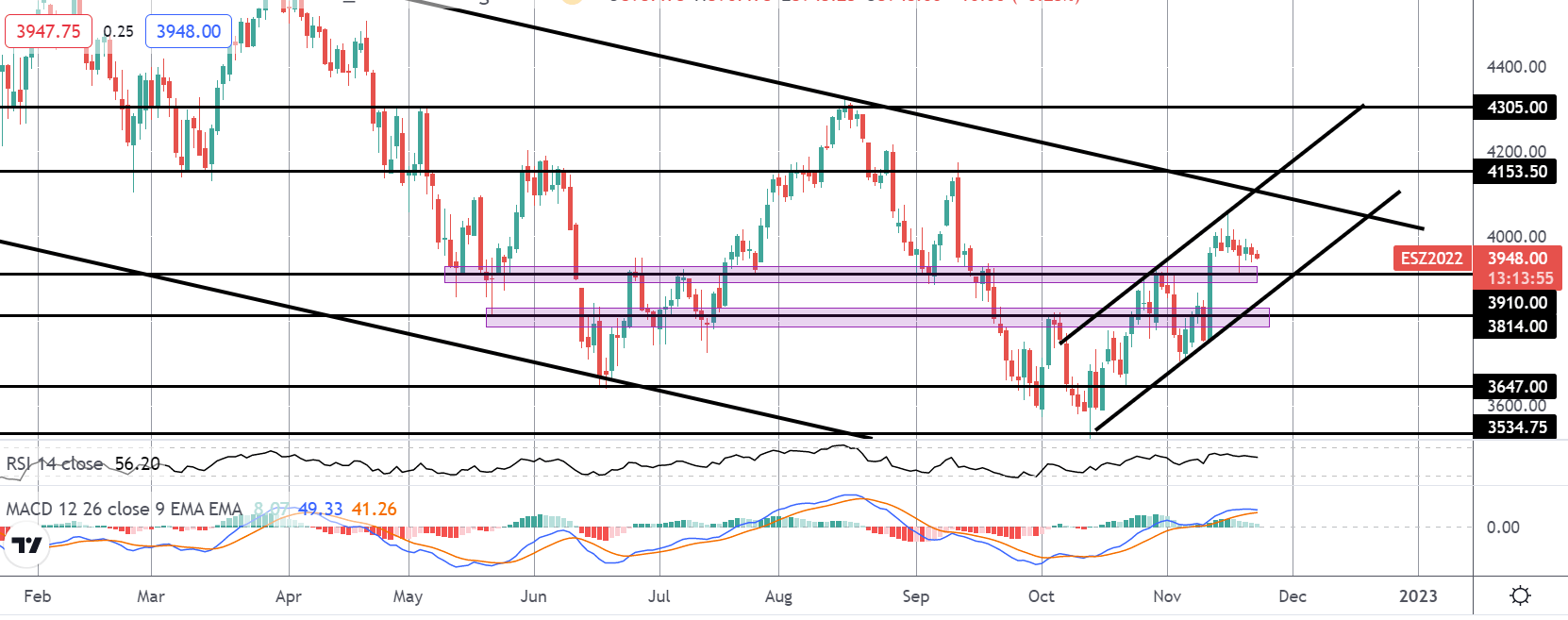

S&P 500

The rally in the S&P, framed by the corrective bull channel off the YTD lows, is fast approaching a test of the bearish trend line from YTD highs. This is a key area for the market and a break above there will be firmly bullish. To the downside, initial support is at the 3910 level, underpinning price currently, with 3814 and the bull channel low sitting beneath.

FTSE

The rally off the YTD lows is continuing with the index attempting to break higher again this week. Price is fast approaching a test of the bear channel top, with structural resistance at 7575.8 – 7678.8 sitting just above. With momentum studies supportive, outlook remains bullish while the market holds above 7362.6.

.png)

NIKKEI

The rally in the NIKKEI stalled into a test of the 28356.6 resistance last week. However, the recent bull move remains intact, with momentum studies supportive, and while price holds above the 27422.9 level, the focus is on a breakout higher and a continuation towards the next resistance level at 29464.9

.png)

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有73%和72%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。