SP500 LDN TRADING UPDATE 8/1/26

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

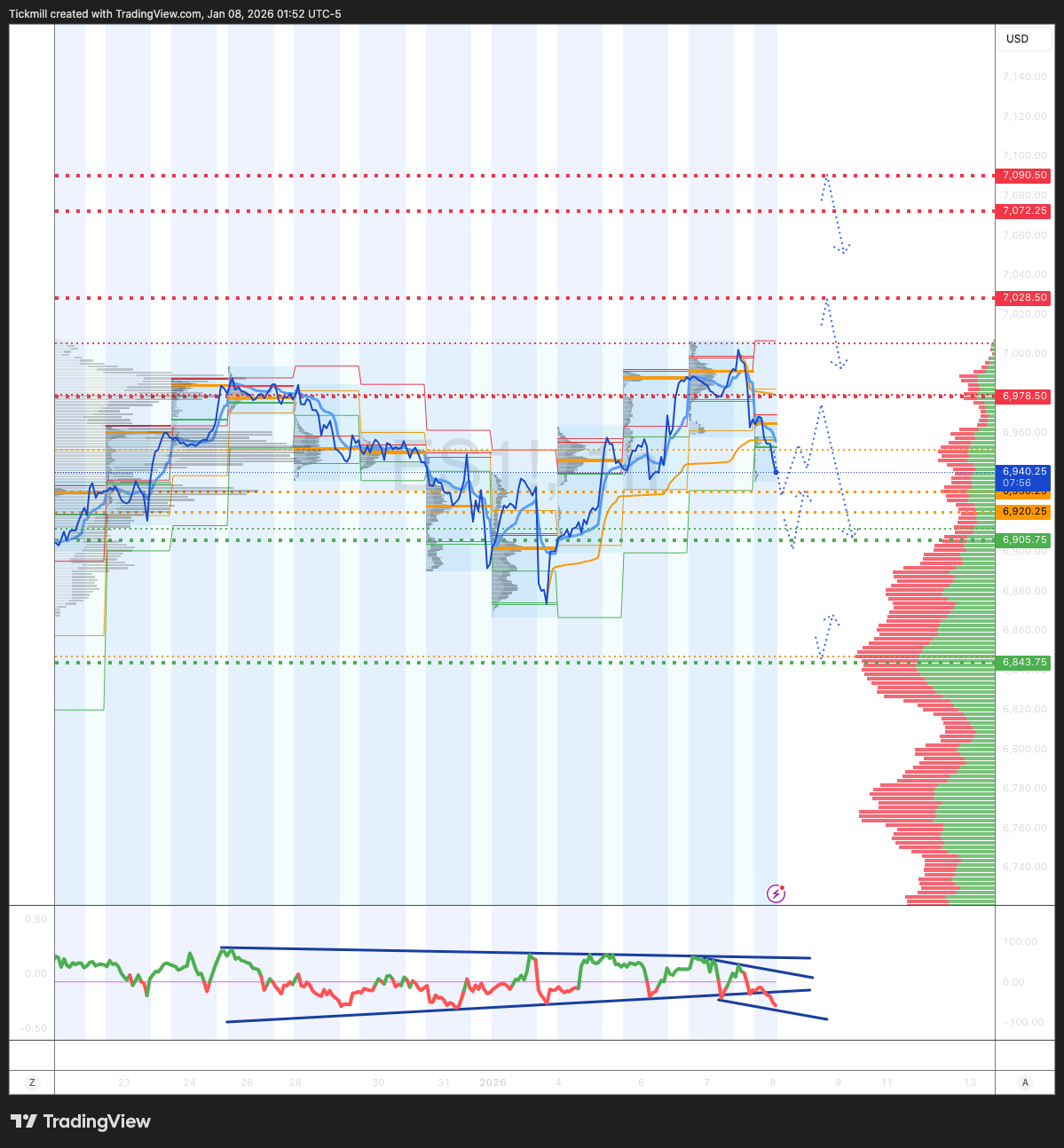

WEEKLY BULL BEAR ZONE 6970/80

WEEKLY RANGE RES 6984 SUP 6817

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

WEEKLY VWAP BULLISH 6882

MONTHLY VWAP BULLISH 6845

WEEKLY STRUCTURE – BALANCE - 6866/6994

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

The SPX aggregate gamma flip region is around 6870. The upside gamma rises sharply from 6930 and above. Conversely, below 6770, it drops sharply to the downside

DAILY STRUCTURE – ONE TIME FRAMING HIGHER- 6959

DAILY VWAP BEARISH 6945

DAILY BULL BEAR ZONE 6931/21

DAILY RANGE RES 7028 SUP 6905

2 SIGMA RES 7090 SUP 66843

VIX BULL BEAR ZONE 17.7

PUT/CALL RATIO 1.14

TRADES & TARGETS

PRIMARY PLAY - LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET 6055>80

LONG ON REJECT/RECLAIM DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE > 6055>80

SHORT ON REJECT/RECLAIM 6080 TARGET DAILY BULL BEAR ZONE > DAILY RANGE SUP

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “CHOPPY”

S&P closed down 34bps at 6,921 with a Market on Close (MOC) imbalance of $760mm to buy. NDX edged up 6bps to 25,654, while R2K dropped 29bps to 2,575, and the Dow slid 94bps to 48,996. A total of 17.46 billion shares were traded across all US equity exchanges, surpassing the year-to-date daily average of 16.78 billion shares. The VIX rose sharply by 427bps to 15.38. WTI Crude fell 140bps to $56.33, the US 10YR yield dipped 3bps to 4.14%, gold declined 90bps to $4,455, the DXY rose 14bps to 98.72, and Bitcoin dropped 234bps to $91,038.

It was a tricky trading session. Early-year high-beta and pro-cyclical themes took a breather, with much of the day spent digesting headlines from former President Trump. Homebuilders and related stocks like BX and INVH faced headwinds following Trump’s comments about limiting large institutional investors from acquiring more single-family homes. Defense stocks also came under pressure after Trump’s remarks opposing dividends or stock buybacks for defense companies. Key names such as LMT, GD, NOC, and LHX fell 3-4%, given the significance of buybacks to these companies. RTX weakened further post-market after a Trump tweet threatened to sever ties with Raytheon over its investments.

In the tech sector, semiconductors continued to show strong demand. INTC surged 9%, becoming the top inbound name of the day. Bartlett highlighted the company's strong geopolitical positioning and noted significant options activity, including 40K C46 contracts expiring Friday. Additionally, a FundAI report pointed to Server CPU shortages as a catalyst.

In consumer sectors, casinos and Macau stocks faced pressure due to escalating Japan-China tensions overnight, compounded by slightly weaker-than-expected December data. In energy, IPP stocks were weaker, even as Sec. Wright delivered a bullish keynote on traditional oil and gas earlier in the day. In healthcare, M&A activity dominated headlines with deals such as VTYX/LLY, Dark Blue/AMGN, and RVMD/ABBV. However, RVMD dropped 17% after hours as AbbVie clarified it was not in discussions with Revolution Medicines (Reuters).

Overall, activity levels on the floor were rated a 7 out of 10. The floor ended the day with net buying of +145bps, compared to a 30-day average of -96bps. Long-only funds were net buyers, with strong demand in tech, financials, industrials, and healthcare, while discretionary saw net supply. Hedge funds were also slight net buyers, with scattered purchases in tech, macro, and discretionary sectors. Geopolitical and macroeconomic factors remained in focus ahead of the Non-Farm Payrolls (NFP) report and a potential Tariff/IEEPA ruling later this week.

In derivatives, trading was relatively quiet throughout the day in both equities and volatility until the final hour, when movement picked up due to long dealer gamma positioning. A notable increase in hedging activity was observed across the market, particularly in VIX calls and spread formats. With volatility compression in recent weeks, hedging via floating strikes remains attractive. The S&P straddle expiring Friday, which captures both the NFP and the potential tariff ruling, priced at 73bps. The desk continues to favor long positions in the front end, despite facing headwinds from dealer flows

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!