Precious Metals Monday 26-08-10

Gold

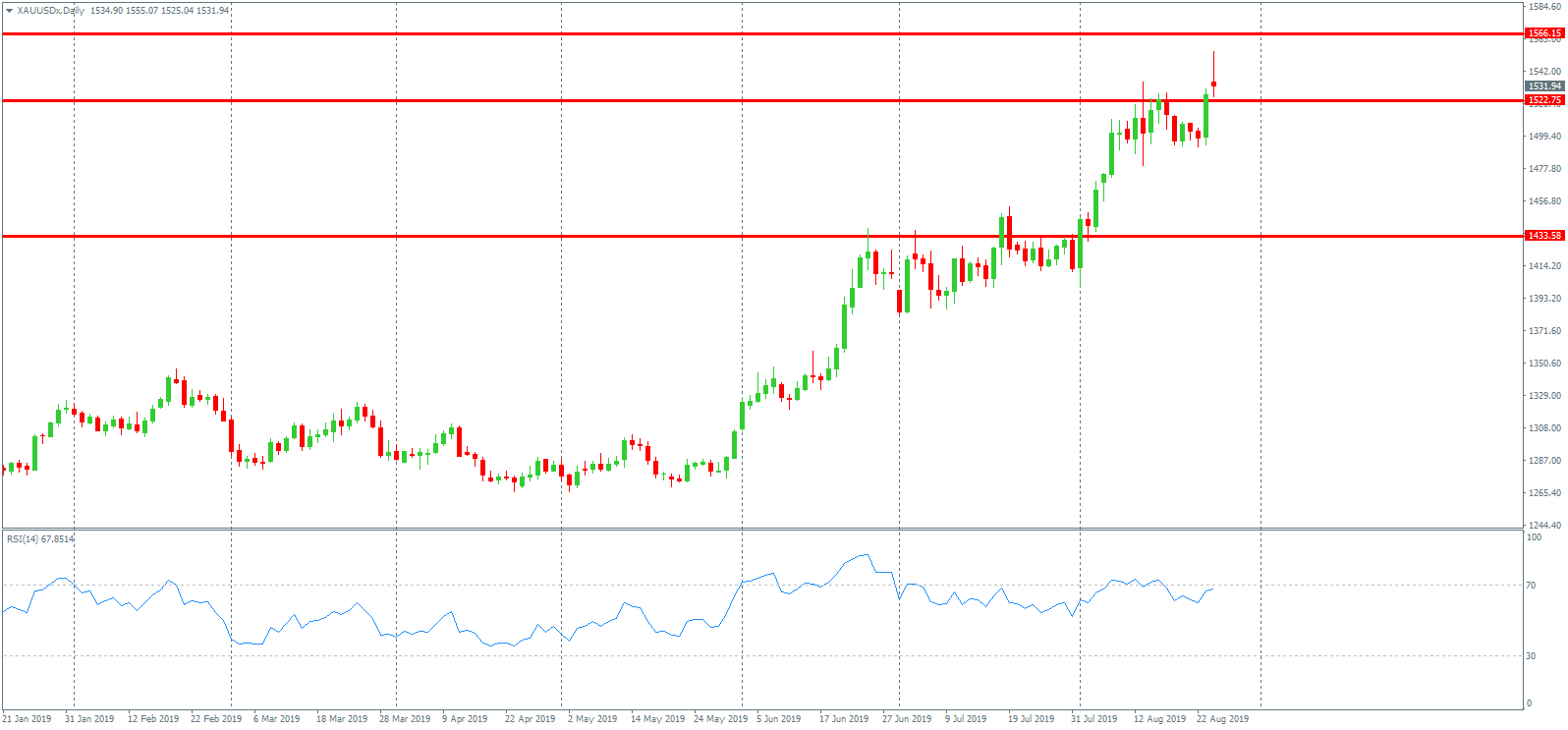

Gold prices have softened a little over early trading today, following an explosive move higher on Friday, in reaction to comments from Fed Chairman Powell. Speaking at the Jackson Hole Symposium, Powell kept further rate cuts firmly on the table, though noted that the Fed is limited in its ability to handle the negative impact of Trump’s trade policies. The comments stoked a swift market reaction and highlighted the Fed’s concern over the economic damage from Trump’s trade war with China.

The comments came on the back of the release of the FOMC minutes earlier in the week, which had initially weighed on gold, as they were not as dovish as many were expecting.

The minutes noted that “most participants viewed a proposed quarter-point policy easing at this meeting as part of a re-calibration of the stance of policy, or mid-cycle adjustment, in response to the evolution of the economic outlook over recent months. A number of participants suggested that the nature of many of the risks they judged to be weighing on the economy, and the absence of clarity regarding when those risks might be resolved, highlighted the need for policymakers to remain flexible and focused on the implications of incoming data for the outlook.”

In reaction to the release, market pricing for a September rate cut weakened slightly, which led the USD higher, weighing on gold prices. Gold was also weighed on by an easing of tensions between the US and China. The two nations are due to meet in September for a further round of talks which looks set to happen at the moment. However, the situation remains fragile and with tensions in Hong Kong ongoing, there is the risk of talks breaking down which would be heavily bullish for gold.

The rally in gold last week saw prices breaking above the major 1522.75 level. This is a key longer term level in gold and while above here, focus is on a further push to the upside with the 156615 level the next topside marker to watch. While focus is on further upside, there is some downside risk with the RSI flagging bearish divergence, suggesting the risk of a reversal lower. If we do move back below 1522.75, the biggest local support is down at the 1433.58 level.

Silver

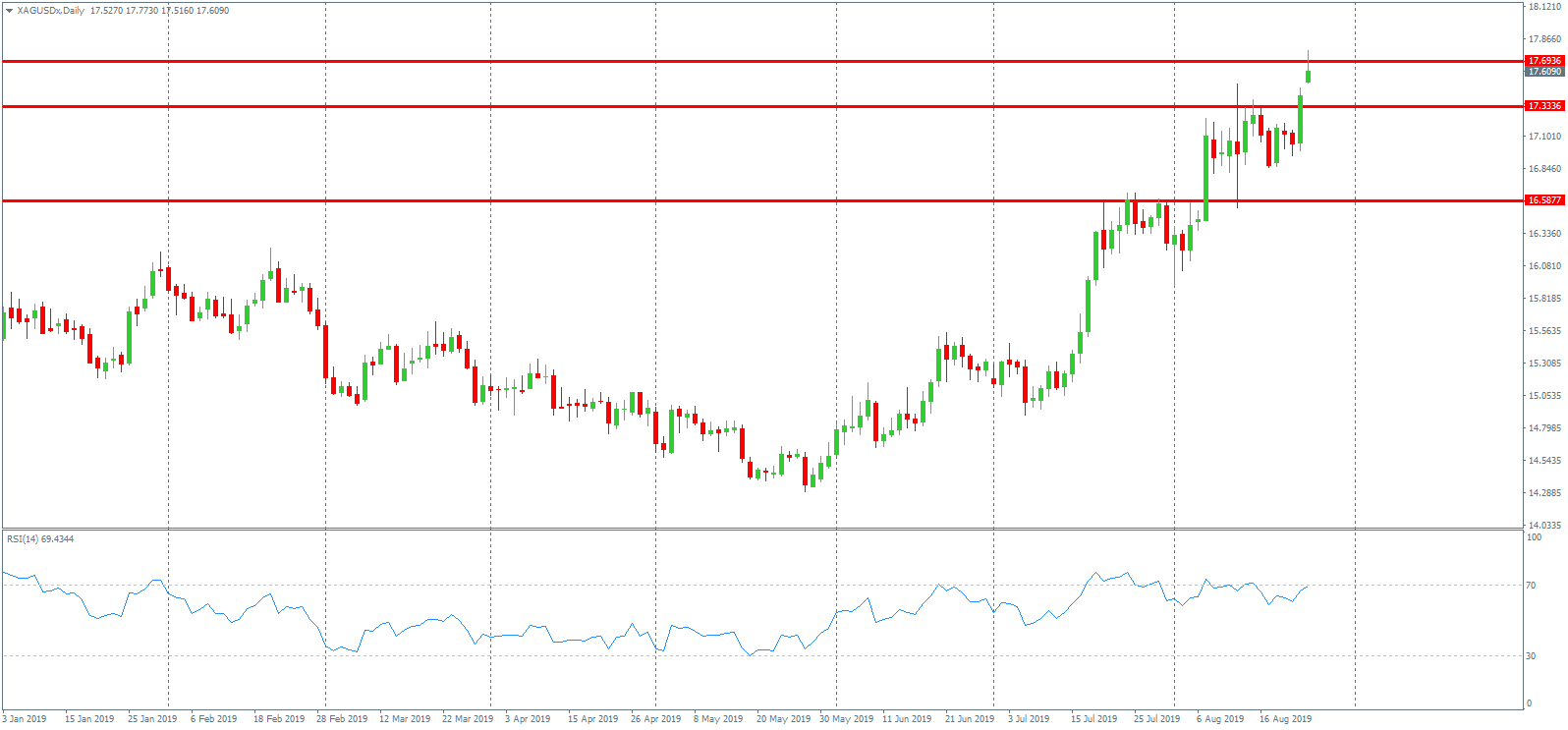

Silver prices have been softer this week also, pulling back from recent highs, as a stronger US dollar has dampened upside for now. Silver prices had been tracking the recent rally in gold, breaking out to their highest levels since early 2018, fueled by escalating trade tensions between the US and China. However, with the US having postponed a portion of the new 10% tariffs due September 1st until a later date, tensions have eased somewhat and the market is now opting to be optimistic around the likelihood of a deal being done.

Silver prices have exploded to the topside today also following a gap higher at the open last night. The market briefly broke above the 17.6936 level today to trade their highest levels since early 2018. However price has since reversed and is trading back below the level now. With the RSI indicator presenting bearish divergence, traders should be aware of the risk of a reversal lower. However, near term, While above 17.3336 focus remains on further upside.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above video are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.