Nasdaq Testing Key Level Ahead of US Data

Nasdaq Attempting to Recover

The Nasdaq is hovering around a key support level as we head into the US open today. The market has corrected heavily lower from the 22,312 highs printed in December. A shift n Fed outlook has seen stocks coming under pressure recently as trader scale back their Fed easing projections this year. Following prior projections of a cut in January, then March, traders are now not pricing a Fed cut until June, with even that pricing very evenly split.

Strong Jobs

Last week’s bumper US jobs report which saw the NFP soaring above forecasts and the unemployment rate falling again, has further diluted Fed easing expectations. The subsequent rise in USD has taken a toll on stock prices with the Nasdaq briefly testing below the 20,668 level this week. Bulls need to keep price above this marker to avoid a deeper drop near-term.

Incoming US Data

Looking ahead this week, there is plenty of volatility risk for the market with a slew of key US data due. Today, traders will receive the latest US PPI figures ahead of tomorrow’s headline CPI data and retail sales on Thursday. Today’s data is forecast to remain unchanged which, if confirmed, should have minimal impact on markets ahead of tomorrow’s headline data.

Inflation On Watch

If CPI tomorrow shows a fresh rise, as expected, this could easily see the Nasdaq breaking down below support as traders push Fed rate cut expectations out further. However, if we undershoot forecasts, USD is vulnerable to a dip lower which should allow stocks room to push higher again. As such, tomorrow’s data will be a key release to watch and holds plenty of volatility risk for stocks near-term.

Technical Views

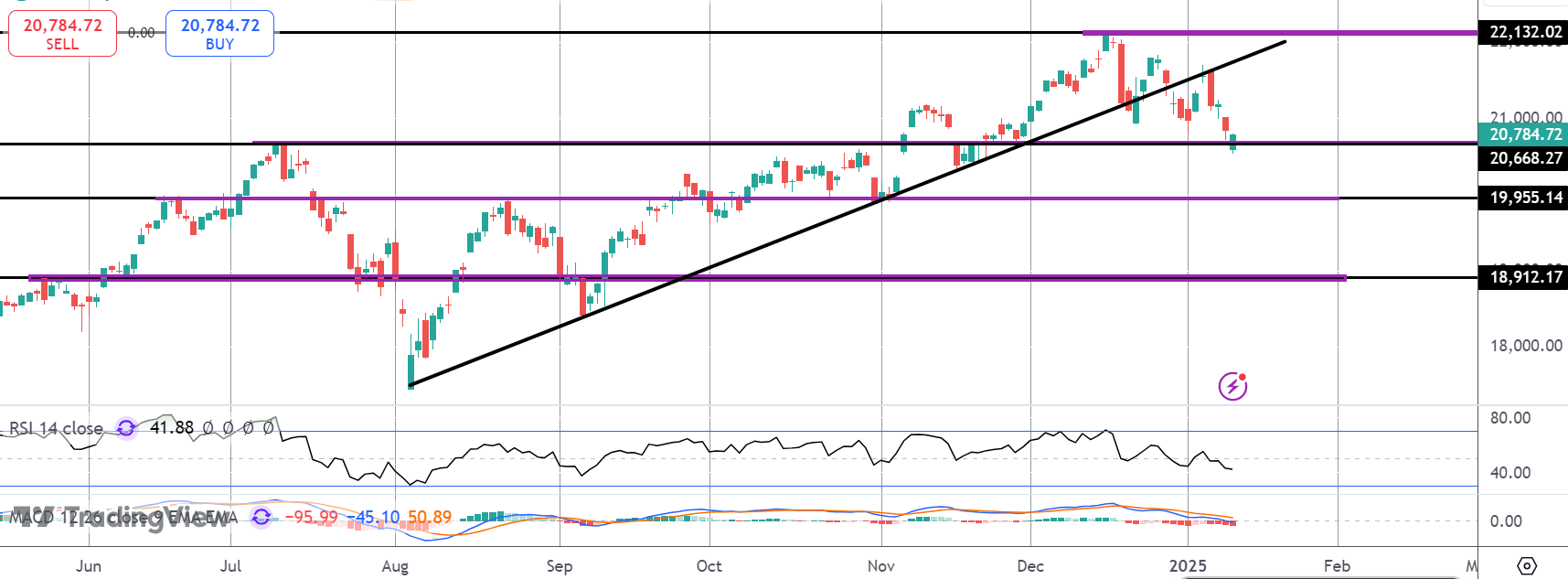

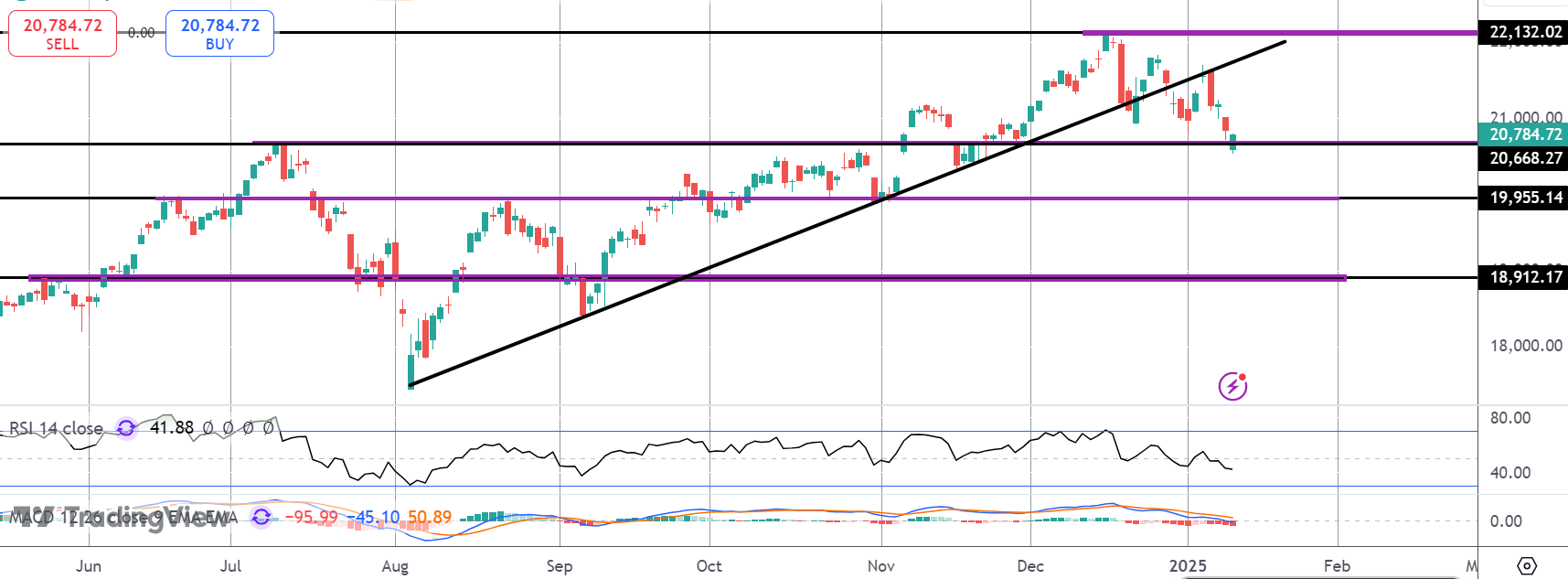

Nasdaq

The sell off in the Nasdaq has seen the market breaking below the rising trend line from 2024 lows. Price is now testing the 20,668-level support. This is a key region for bulls to defend to maintain the broader bullish view. If we break below here, focus turns to deeper support at the 19,955 level, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.