Institutional Insights: Goldman Sachs - Trading US CPI

From GS Research:

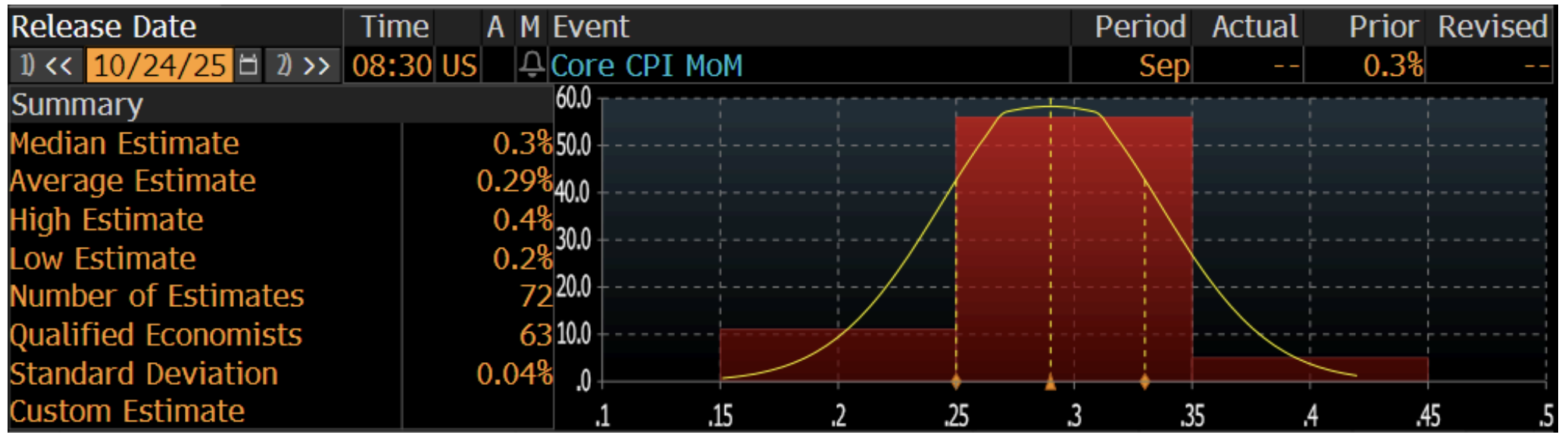

We project a 0.25% increase in September core CPI (compared to the consensus estimate of +0.3%), translating to a year-over-year rate of 3.05% (vs. the consensus of +3.1%). For headline CPI, we anticipate a 0.27% rise (vs. +0.2% consensus), driven by higher food prices (+0.3%) but offset by lower energy prices (-0.6%). This aligns with a year-over-year rate of 2.80% (matching the consensus of +2.8%).

Key component-level trends expected in the report:

Used and New Car Prices: We foresee used car prices remaining flat, based on auction price signals, and a modest increase in new car prices due to downward pressure from increased dealer incentives.

Car Insurance: A 0.3% rise in the car insurance category is expected, reflecting premium trends observed in our online dataset.

Airfares: We predict a 1.5% decline in airfares for September, driven by the fading impact of seasonal distortions and a reduction in underlying ticket prices, supported by our equity analysts’ tracking of online airfare data.

Tariff Effects: Upward pressure from tariffs on categories like communication, household furnishings, and recreation is anticipated, contributing approximately +0.07 percentage points to core inflation.

In the coming months, we expect tariffs to continue exerting upward pressure on monthly inflation, forecasting core CPI inflation to remain around 0.2-0.3% per month. Excluding tariff effects, we anticipate underlying trend inflation to decline further, influenced by reduced contributions from the housing rental and labor markets. By December 2025, we forecast year-over-year core CPI inflation at +3.1% and core PCE inflation at +3.0% (or +2.2% for both measures excluding tariff impacts).

Note: A potential government shutdown poses risks to the accuracy of October’s CPI data, as most prices are collected manually and cannot be replaced with retroactive data.

SPX implied move for CPI: ~0.60%.

Estimate distribution for September Core CPI MoM: Provided in the report.

Thoughts from GS:

Vickie Chang (Global Macro Research)

Tariff and credit concerns have been the dominant themes in recent weeks, especially in the absence of significant US economic data. Since October began, the market has modestly downgraded growth expectations overall. However, the more sustained trend since the initial concerns over China tariff threats has been a dovish shift in the market’s perception of the Fed. The market is fully pricing in the rate cuts forecasted for the remainder of the year and is anticipating more cuts than our baseline forecasts for next year, though pricing remains slightly above our "scenario-weighted" outcomes.

The market’s shift toward pricing additional easing has been driven by a weaker labor market rather than inflation concerns, making this CPI print unlikely to be a decisive factor. There’s a modest asymmetry here: a higher-than-expected CPI print might cause temporary market discomfort, especially given the easing already priced in, but it’s unlikely to significantly alter the Fed’s outlook—gradual rate cuts in the near term seem assured given labor market conditions and the current lack of clarity. Similarly, the market is unlikely to revise its views on 2026 rate cuts based on this inflation print, as tariffs are still temporarily influencing price levels. A softer or in-line CPI print (our forecasts are slightly below consensus) could provide the market with more reason to price a dovish Fed stance.

Our bias leans toward being long risk assets, but in the near term, it’s prudent to hedge against growth concerns (equity downside screens favorably) given the unresolved labor market and trade risks. Should these risks diminish and growth optimism return, shifting focus toward protection against rising rates might become more relevant.

Karen Fishman (FX Research)

The CPI report stands out as one of the few data releases during the government shutdown. While surprises could heighten market volatility, the threshold for impacting Fed pricing feels high, especially with terminal rates already below our economic team’s forecast and the Fed’s greater emphasis on labor market risks. One notable trend in recent months has been the limited pass-through of tariffs into consumer prices. If this continues, concerns about inflation’s upside risks may further ease.

In FX, the Dollar was rangebound for much of the summer before strengthening recently, driven by a weaker JPY following Takaichi’s unexpected election in Japan and EUR weakness stemming from political issues in France. This has dampened expectations for renewed Dollar downside, particularly as the Dollar’s correlation with equities has normalized—USD rising when equities fall and vice versa. However, the correlation with the VIX remains unusual, reducing the value of holding USD as a hedge for equities. Recent trade and regional bank concerns have weighed on both equities and the Dollar, particularly against JPY, CHF, and most European currencies (though credit fears traditionally support the Dollar). These risks continue to justify further hedging and marginal reallocation shifts, reinforcing our view that the Dollar is likely to weaken over time. The CPI report is unlikely to change this outlook, barring an unexpected hot print that challenges the justification for current yields.

Joe Clyne (Index Vol Trading)

Heading into the CPI release, the desk favors short volatility strategies for directional views. Last week saw large realized vol-of-vol moves, including a dramatic vol squeeze on Thursday that was fully unwound earlier this week. While the vol spike has largely dissipated, vol levels remain elevated, with the front two VIX futures trading just below 20. We anticipate vol underperformance in a rally as we approach systematically sold vega strikes, and limited vol outperformance in a selloff given the distance from VIX settlement (reducing dealers’ short vol-of-vol exposure). Short gamma is also appealing, even with a relatively low base leading into CPI.

For those seeking protection, pairing short vol and short gamma with long skew is advisable as skew has retraced to the middle of its post-Liberation Day range. Our preferred trade is the year-end 6000-6900-7200 call spread collar, designed to benefit from a vol-dampening rally heading into year-end.

Shawn Tuteja (ETF/Basket Vol Trading)

Tomorrow’s CPI release is unlikely to be a major event for broad equity indices. With US-China relations, next week’s FOMC meeting, private credit concerns, and megacap earnings all on the horizon, the market is likely to focus more on the Fed’s messaging regarding future rate cuts rather than a higher CPI print.

Equity markets have faced challenges recently, with poor performance among recent winners. Our Prime Brokerage team estimates quant MTD performance at -170 bps, and discussions with equity L/S funds suggest alpha generation has been difficult in recent weeks. Despite this, most clients maintain a medium-term bullish outlook, expecting the market to trade higher and the economy to reaccelerate next year. Gross exposures remain elevated (5

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!