FOMC Preview - Will The Fed Announce Fresh Easing?

Market Looking For .25% Rate Cut

The main focus for traders today will be the FOMC decision, due later on in the US session. The meeting is one of the most keenly anticipated FOMC meetings in recent history as the Fed is widely expected to announce fresh easing. Indeed, in line with recent commentary and guidance from the Fed, the market is pricing in a 100% chance of a rate cut with the CME group’s Fed Watch tool showing a 75% chance of a .25% cut and a 25% chance of a .50% cut!

.50% Now the Outside Scenario

The odds of a larger rate cut had been far higher over prior weeks in line with aggressive dovish comments from Fed’s Williams, and severe weakness in manufacturing data. However, with the Fed having clarified Williams’ comments and with other key data since then having rebounded, odds have fallen again, with the market now looking for a .25% cut as the base scenario. This view has gained further traction since Fed’s Bullard, known as one of the more dovish members, opined that in his view, a .25% rate cut was enough.

While there will be no update to forecasts or dot plots at this meeting, the market will be paying close attention to the decision statement for changes as well as the post-decision press conference for forward guidance.

Fed To Highlight Continued Risks

In terms of the outlook and guidance, the Fed is likely to highlight the ongoing risks to US economic expansion. Indeed, although we have seen some pick-up in recent US data, inflation remains subdued and the global growth environment remains precarious. With this in mind, the Fed is likely to highlight the potential for further cuts over the remainder of the year as necessary.

Statement Guidance Likely To Remain The Same

The Fed’s approach over the remainder of the year is likely to be outlined in the concluding paragraph of the decision statement, which should remain as follows: “In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2% inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.”

Key Focus Points In The Press Conference

Of particular interest in the press conference will be if Fed chairman Powell is asked about the prospect of US treasury intervention in USD, given recent headlines. Traders will also be keen to hear Powell’s thoughts on the renewed US China trade talks which got underway this week. The key point though will be around Powell’s guidance for further easing. If Powell downplays the likelihood of further easing, this could cause a strong move higher in USD, which would be a disappointing result for the Fed. In all likelihood, the case for further easing should be made very clear.

Technical Perspective

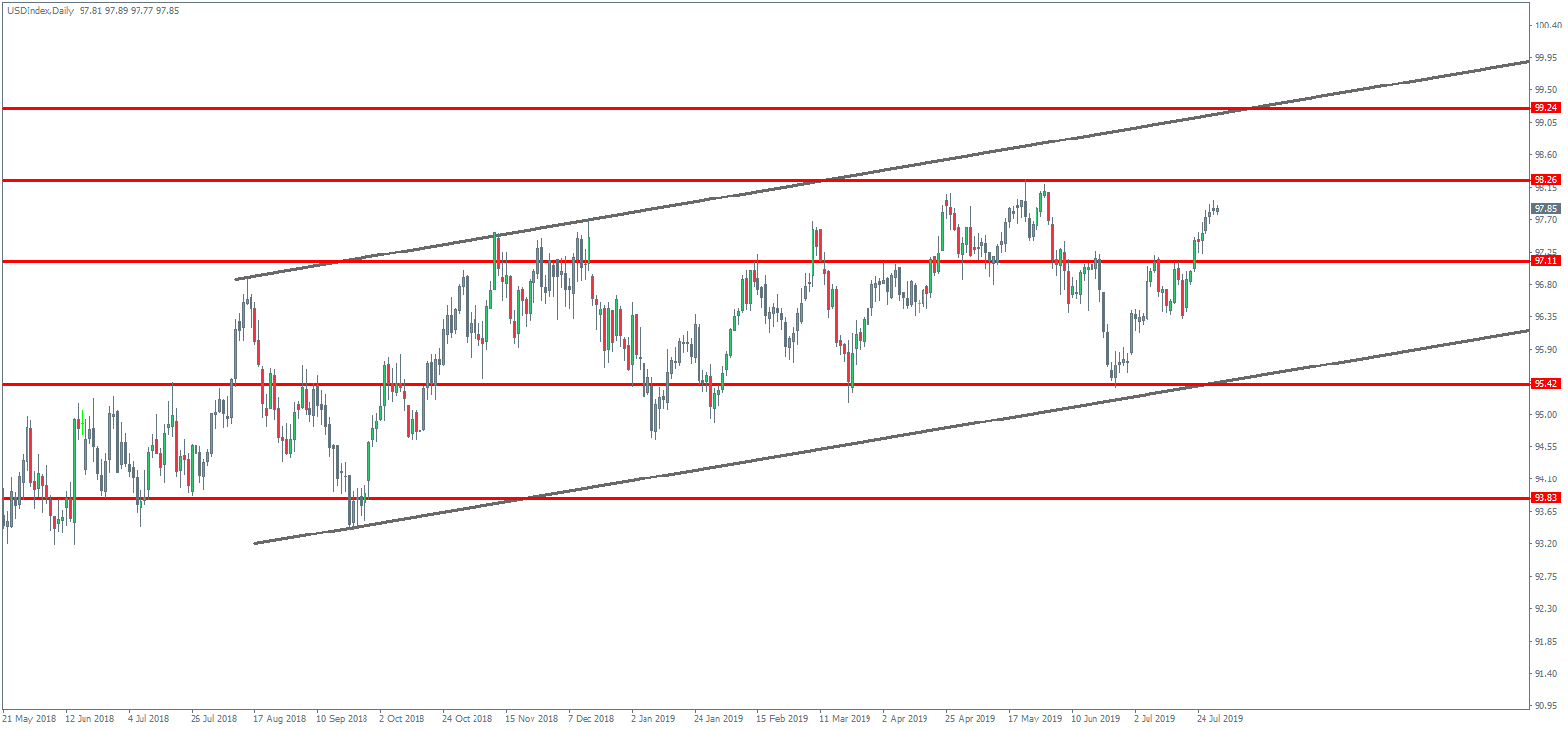

The current USD rally has seen the index trading up strongly off the recent 95.42 lows to just shy of 2019 highs at 98.26. Price remains within the upper portion of the recent bullish channel for now. While above the recently broken 97.11 level, focus will be on further upside and above the 2019 highs, the next level to watch will be the 99.24 structural resistance where we also have the top of the bullish channel offering confluent resistance.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.