Daily Market Outlook, August 2, 2024

Daily Market Outlook, August 2, 2024

Munnelly’s Macro Minute…

“A Sea Of Red As US Recession Fears & Geopolitical Tensions Rise”

Amid worries about the outlook for global economic growth following some disappointing economic data from the U.S., Europe, and China that offset optimism about a near-term interest rate cut by the US Fed, Asian stock markets are a sea of red on Friday. This is in response to the overnight negative cues from global markets. Data revealed that first-time claims for unemployment benefits in the United States reached their highest point in over a year last week, and that manufacturing production in the country unexpectedly shrank at an accelerated rate in July. Traders are currently awaiting the highly anticipated report on employment for July from the US Labor Department. The Japanese stock market is currently trading considerably lower on Friday, compounding the strong losses from the previous session. This is due to the general bearish indications from global markets overnight. The benchmark Nikkei 225 is declining by over 4%, closing well below the 36,600 mark. The largest sectors experiencing difficulties are technology and financial companies, as well as index heavyweights.

The head of Hamas' military wing, Mohammed Deif, was killed in an Israeli bombing in Gaza last month, the Israeli military claimed on Thursday, one day after the political leader of the party was assassinated in Tehran.

Europe has a light data schedule, so the attention is on the U.S. nonfarm payrolls report this afternoon; a miss would just hasten the risk retreat. Market consensus is that July's job growth was 175,000, compared to 206,000 the previous month. The unemployment rate, which is anticipated to remain at 4.1%, will also be under scrutiny.

Overnight Newswire Updates of Note

Australian Dollar Recovers Losses Following PPI Data

EU Prep, Potential Return of Trump To Power

A US Recession Is Not Off The Table Yet

Feds Put Nvidia AI Deal Under Antitrust Scrutiny

US’s Joe Biden’s Call With Israel's PM Netanyahu

Apple’s Revenue Rose Despite China Slowdown

Amazon Earnings Jump On Cloud Computing Strength

Intel Plans Job Cuts, Spending To Shore Up Finances

Tech Sell-Off Leads US Stocks Lower And 10Y Yield Sinks

Asian Stocks Broadly Lower After Wall Street Sell-Off

Companies See Limited Financing Impact; BoJ Hike

China Bond Traders Seek Refuge, Amid PBoC Fears

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0725-35 (600M), 1.0740-50 (2.47BLN) 1.0770 (657M), 1.0785 (690M), 1.0800 (665M), 1.0850 (670M) 1.0865-75 (536M), 1.0885 (302M), 1.0900-10 (734M)

USD/JPY: 151.00 (1.22BLN)

USD/CHF: 0.8830-35 (510M).

EUR/CHF: 0.9360 (400M)

GBP/USD: 1.2815 (230M), 1.2850-60 (624M)

EUR/GBP: 0.8420-25 (1.2BLN), 0.8460 (1.1BLN)

AUD/USD: 0.6575 (301M), 0.6625-30 (555M), 0.6640 (289M)

NZD/USD: 0.5975 (582M), 0.6000 (200M). AUD/NZD: 1.1025 (545M)

USD/CAD: 1.3800 (518M), 1.3895-00 (1.02BLN)

USD/ZAR: 18.6620 (555M), 18.70 (1.22BLN)

CFTC Data As Of 23/7/24

Equity fund managers cut S&P 500 CME net long position by 2,812 contracts to 994,529

Equity fund speculators trim S&P 500 CME net short position by 89,786 contracts to 280,356

Japanese yen net short position is -107,108 contracts

Swiss franc posts net short position of -42,237 contracts

British pound net long position is 142,183 contracts

Euro net long position is 35,906 contracts

Bitcoin net short position is -661 contracts

Technical & Trade Views

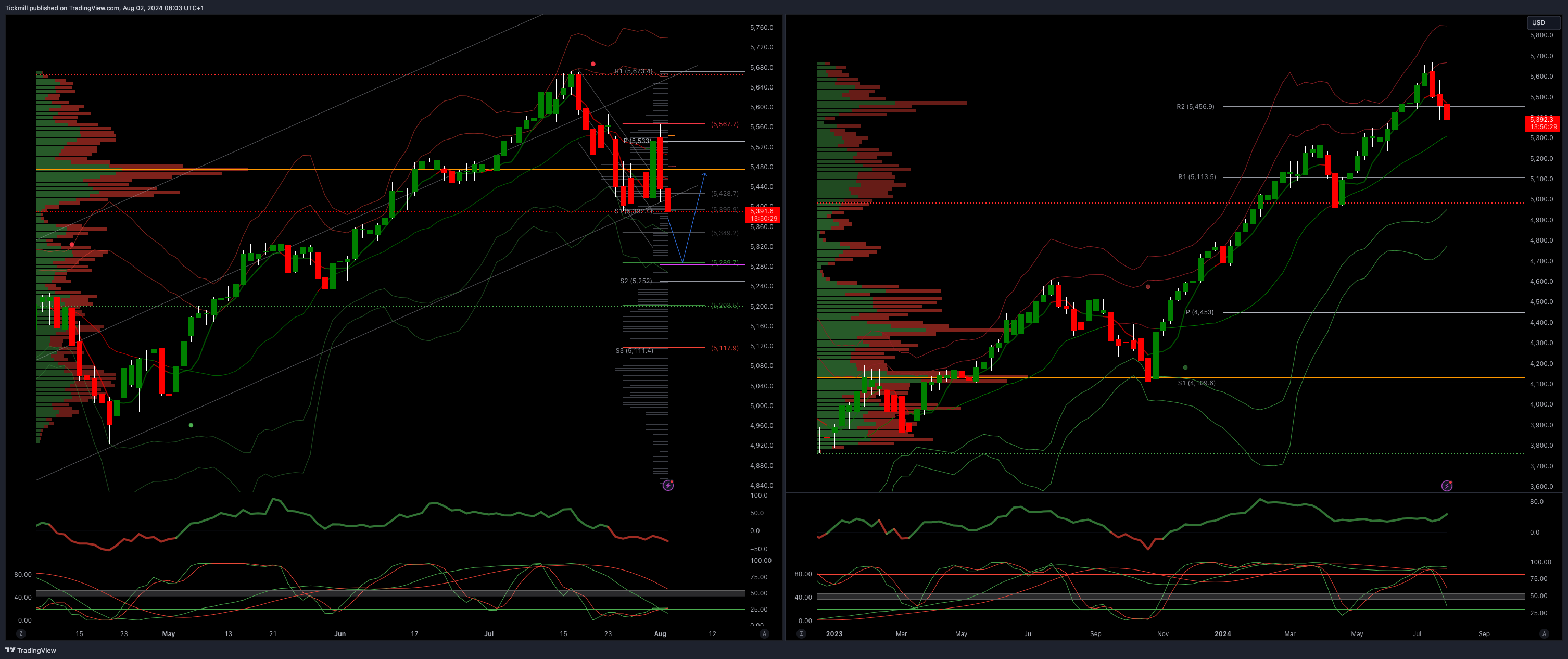

SP500 Bullish Above Bearish Below 5400

Daily VWAP bearish

Weekly VWAP bearish

Below 5400 opens 5289

Primary support 5400

Primary objective is 5700

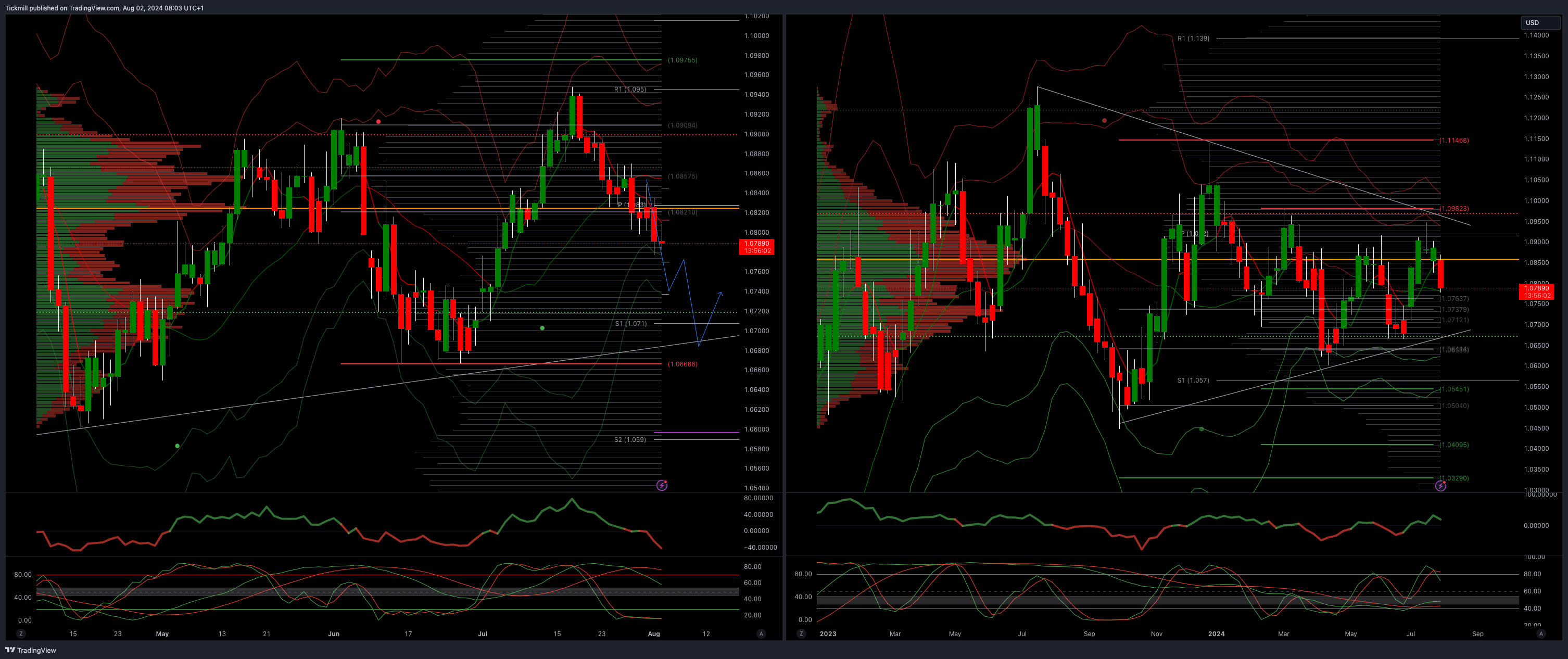

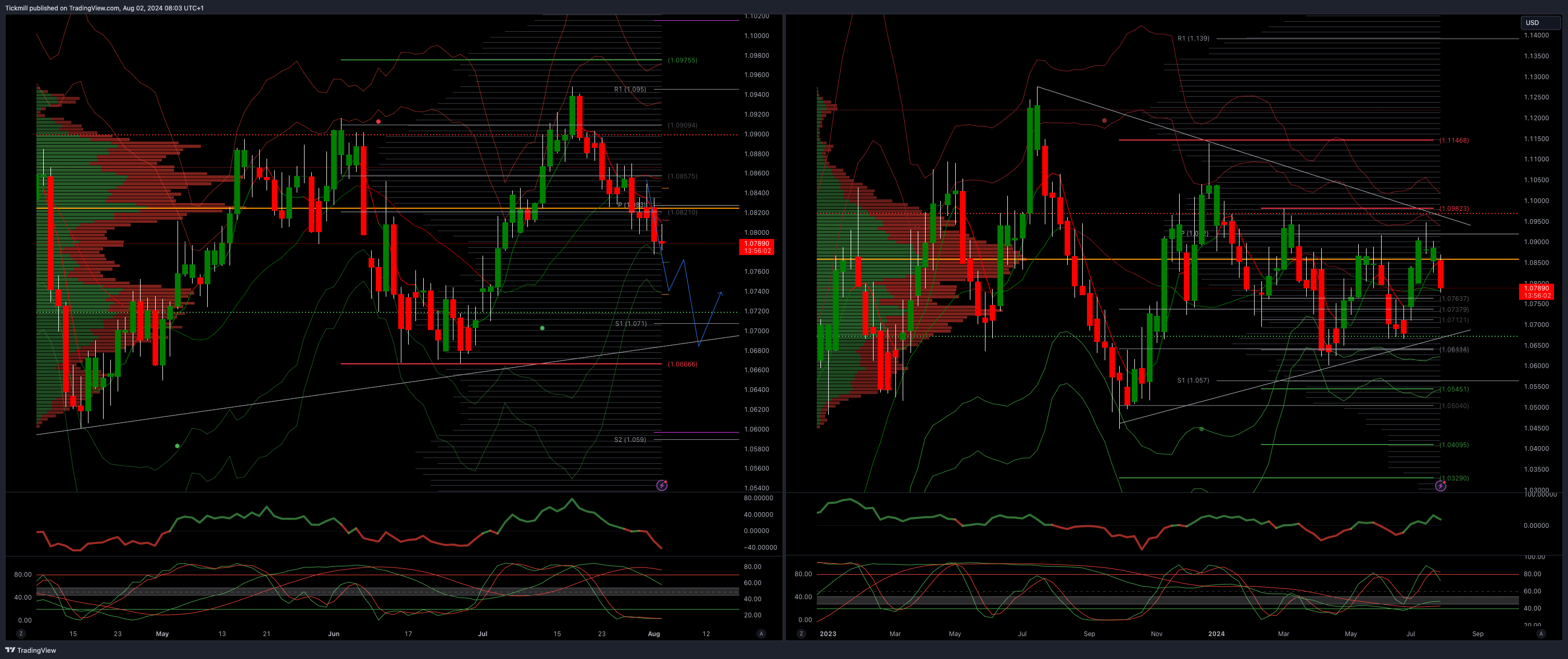

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.07

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.2450

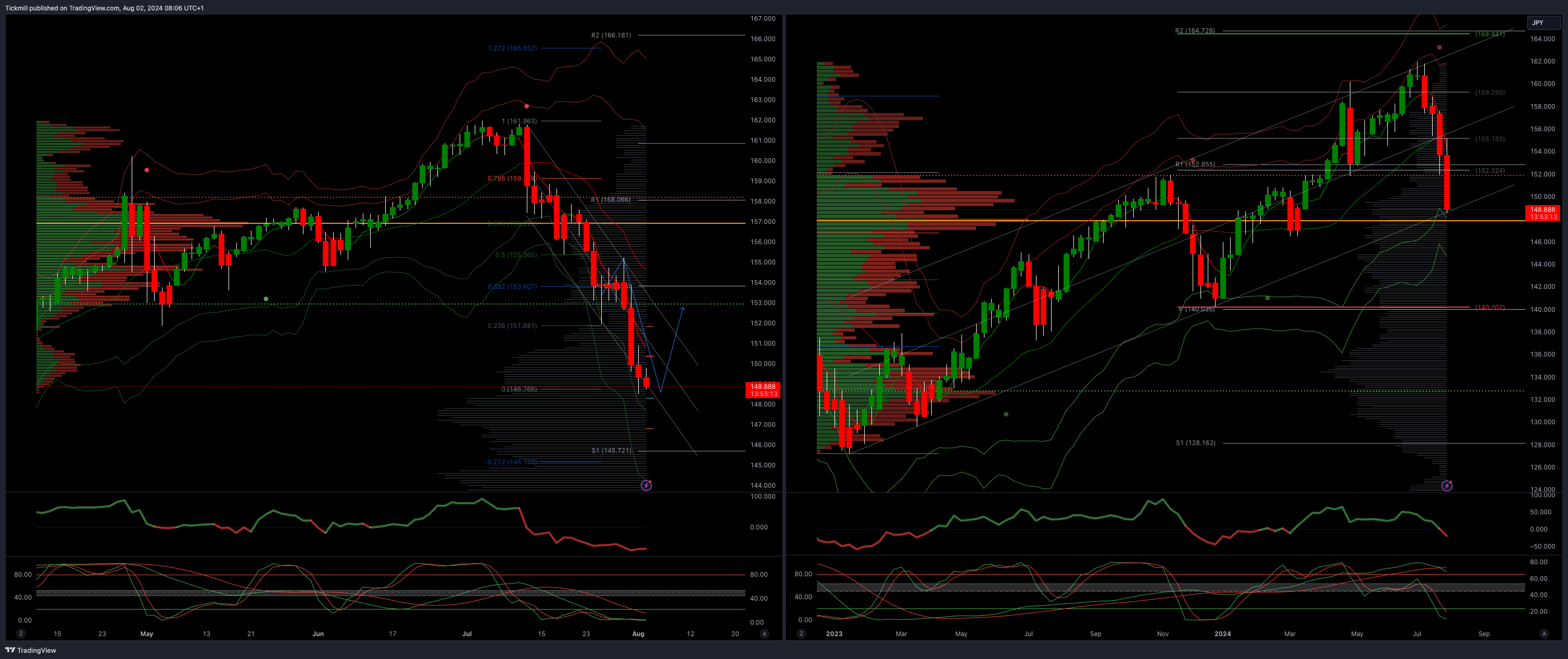

USDJPY Bullish Above Bearish Below 150

Daily VWAP bearish

Weekly VWAP bearish

Above 150 opens 153

Primary support 148.70

Primary objective is 164.30

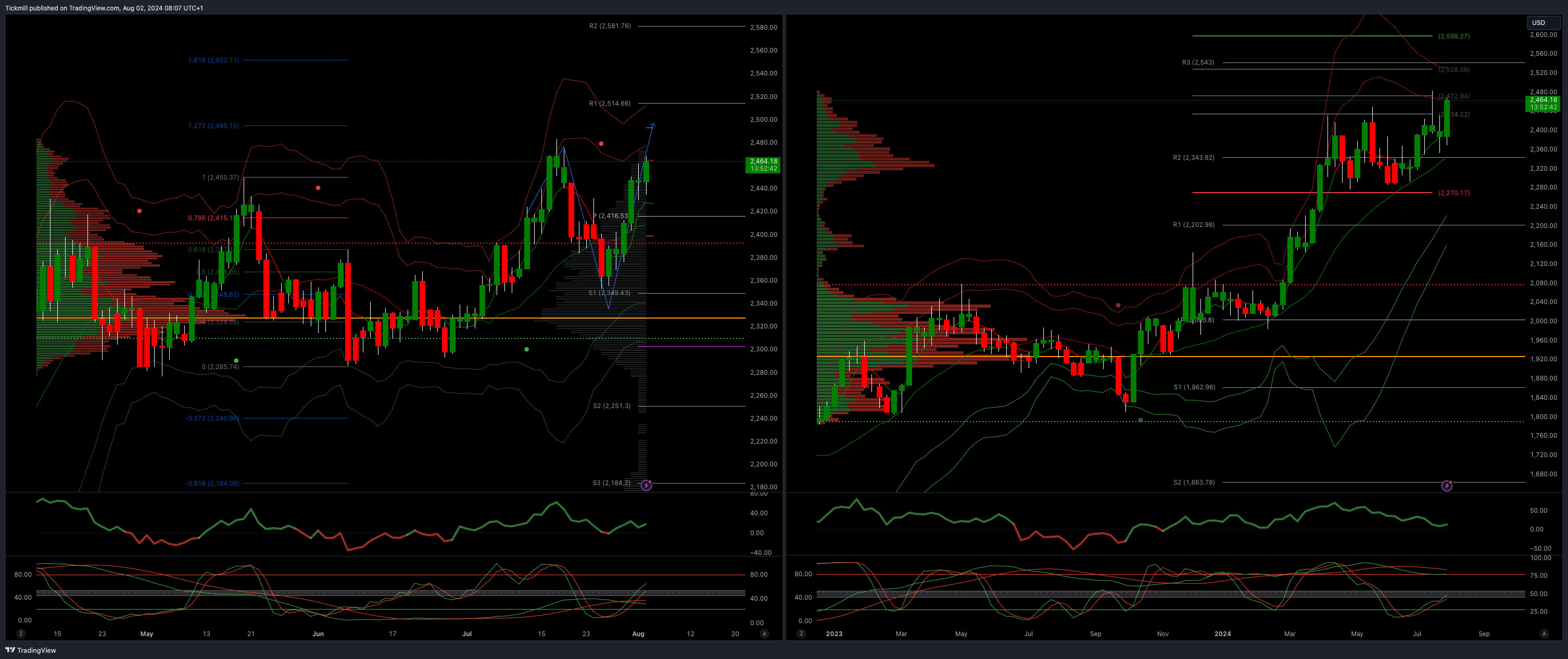

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

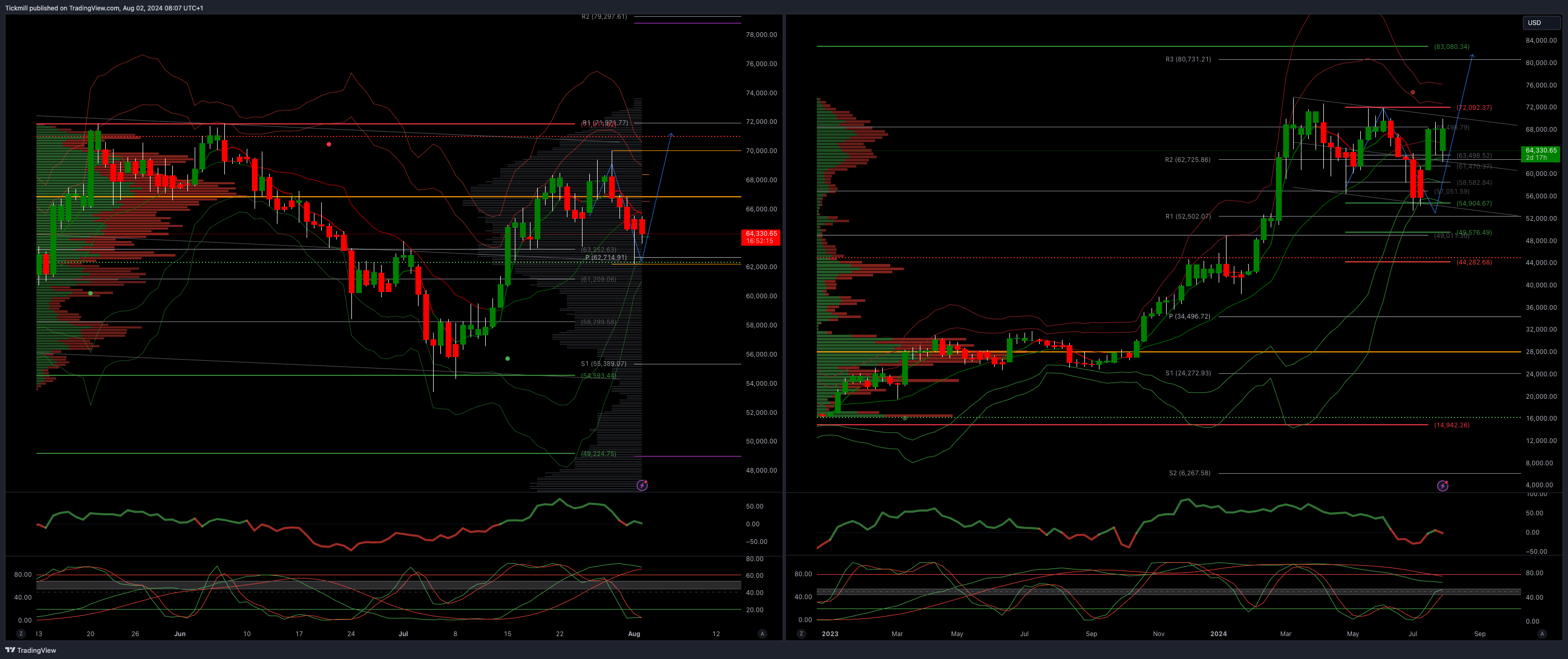

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bullish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!