Daily Market Outlook, August 13, 2024

Daily Market Outlook, August 13, 2024

Munnelly’s Macro Minute…

“US Inflation Data Eyed As The Main Driver For A Fed Move ”

Following mixed signals from Wall Street overnight, Asian stock markets are trading mixed on Tuesday. Traders appeared hesitant to make big changes in positioning ahead of the release of important US inflation numbers later in the day and tomorrow, which are expected to have an impact on the outlook for US interest rates. Tuesday's post-holiday trading has seen a significant increase in the Japanese stock market, building on the gains of the previous session. Following conflicting overnight indications from Wall Street, the Nikkei 225 is rising more than 2.5 percent to above the 36k handle. Strong advances across all sectors are being led by index heavyweights and technology firms.

Regarding the US Federal Reserve's September interest rate reduction, there is yet hope. With a 51.5 percent probability of a rate cut of 25 basis points and a 48.5 percent probability of a rate cut of 50 basis points, the CME Group's FedWatch Tool is currently forecasting a rate decrease in September.

Before attention turns to the consumer price index data for July, which are slated for Wednesday, U.S. producer pricing data, which are coming later in the day, are expected to influence markets. This week's data dump is completed on Thursday with the retail sales report.

Later in the day, Federal Reserve Bank of Atlanta President Raphael Bostic is scheduled to speak, so investors will also be watching for his remarks. Meanwhile, UK wage data is expected to dominate European hours.

As for the conversation between billionaire entrepreneur Elon Musk and Republican presidential candidate Donald Trump, attendees had to wait a while for it to start because of a long delay brought on by technical issues that prevented many users from accessing the live feed.

Overnight Newswire Updates of Note

Tech Problems Overshadowed Trump-Musk X’s Interview

Australia’s Wages Elevated, Underlining Price Pressures

BofA CEO Reveals Problems With US Consumer Money

Japan’s PPI Stay Elevated, Yen Weakness Fuels Import Costs

Japan's Parliament To Hold Aug 23 Session On BoJ Rate Hike

Japan Stocks Gains As Nikkei Climbs Above 2% After Holiday

Chipmakers Face A Looming Crisis In Labour

UKMTO Reports Incidence Southwest Of Yemen's Hodeidah

US And South Korea Start Joint Military Exercises Next Week

US Warns Iran Attack On Israel Could Come This Week

Oil Prices Ease As Markets Refocus On Demand Worries

XAU Trims Overnight Gains Ahead Of US Inflation Data

Israel Puts Military On High Alert, US Sends Assets To Middle East

Putin: Recent Ukraine’s Attack, Aimed At Ceasefire Negotiations

FitchRatings Downgraded Isreal From A+ To A, Outlook Negative

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0820-25 (2.4B), 1.0840 (641M), 1.0865-75 (1.4B), 1.0900 (2.0B)

EUR/USD: 1.0930 (896M), 1.0960 (849M)

USD/JPY: 146.25 (1.2B), 147.60 (350M). AUD/JPY: 95.50 (360M)

GBP/JPY: 185.50 (394M)

GBP/USD: 1.2850 (300M). EUR/GBP: 0.8580 (230M)

AUD/USD: 0.6575 (1.5B), 0.6675 (1.1B). AUD/NZD: 1.1050 (553M)

CFTC Data As Of 09/8/24

Equity fund speculators trim S&P 500 CME net short position by 25,312 contracts to 222,856

Equity fund managers cut S&P 500 CME net long position by 57,309 contracts to 881,533

Swiss franc posts net short position of -22,073 contracts

British pound net long position is 74,399 contracts

Euro net long position is 33,580 contracts

Japanese yen net short position is -11,354 contracts

Bitcoin net long position is 538 contracts

Technical & Trade Views

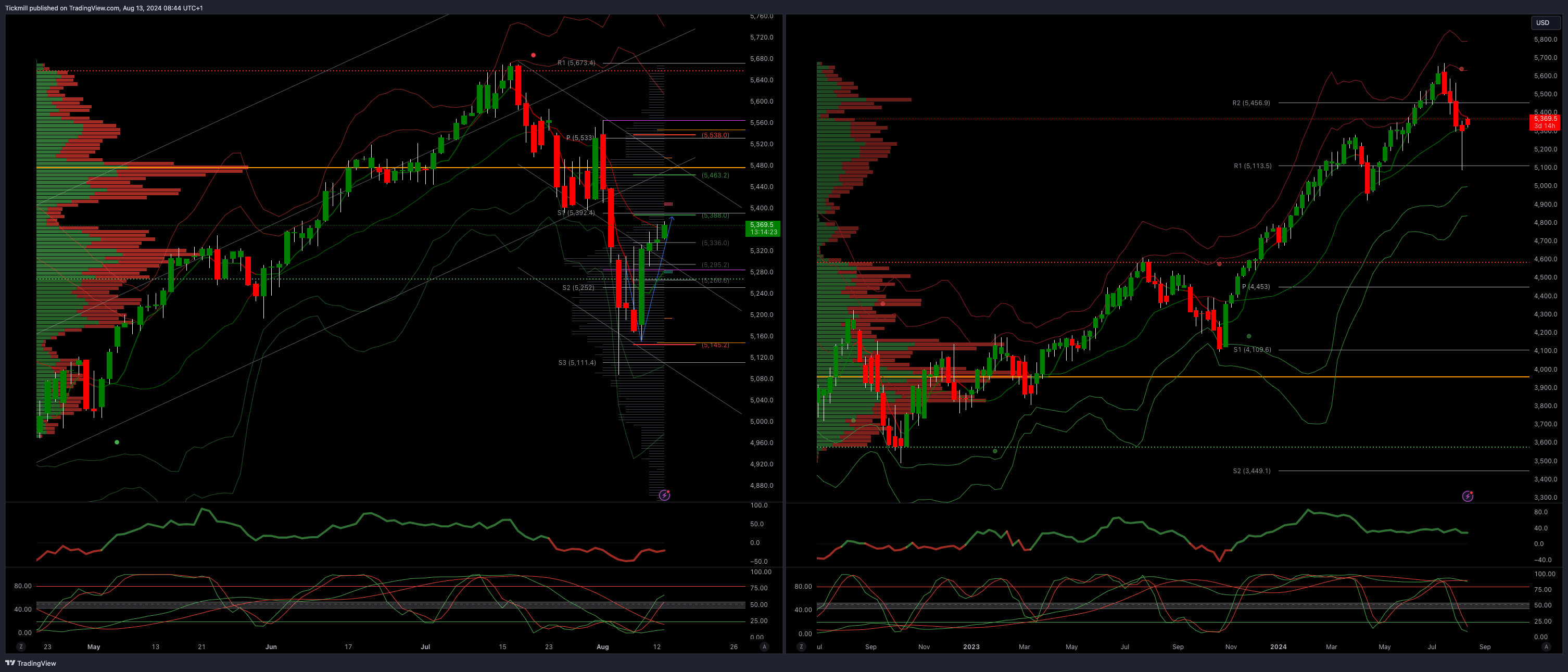

SP500 Bullish Above Bearish Below 5150

Daily VWAP bullish

Weekly VWAP bearish

Above 5388 opens 5470

Primary resistance 5470

Primary objective is 5000

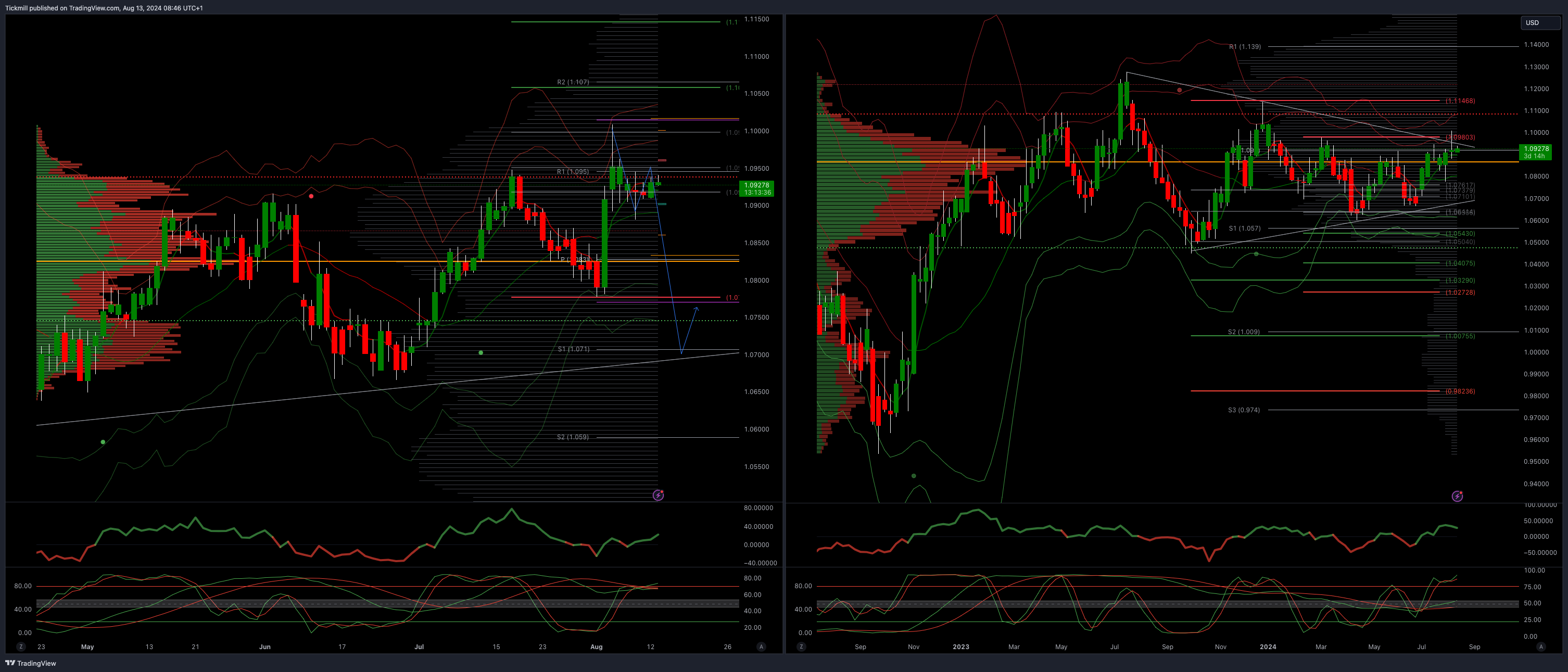

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0975 opens 1.1075

Primary resistance 1.0981

Primary objective is 1.07

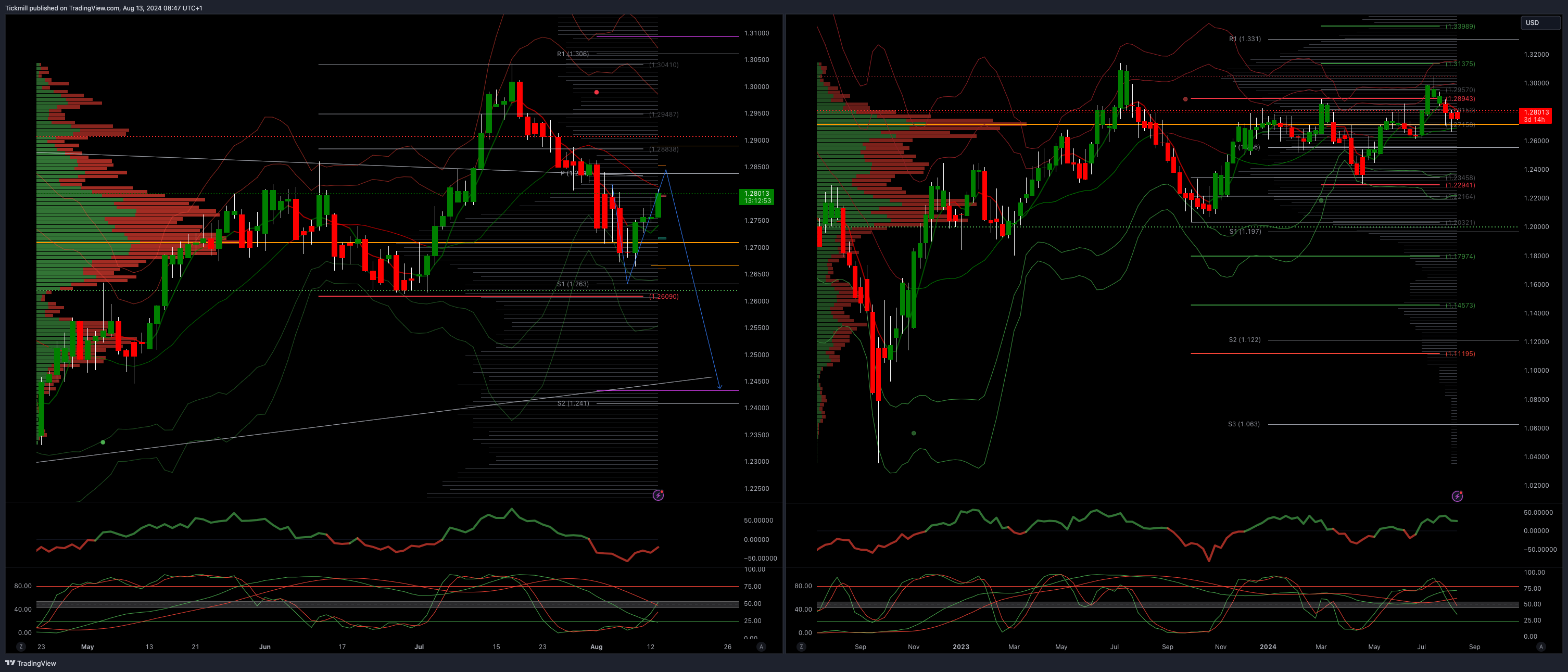

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bullish

Weekly VWAP bearish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.2450

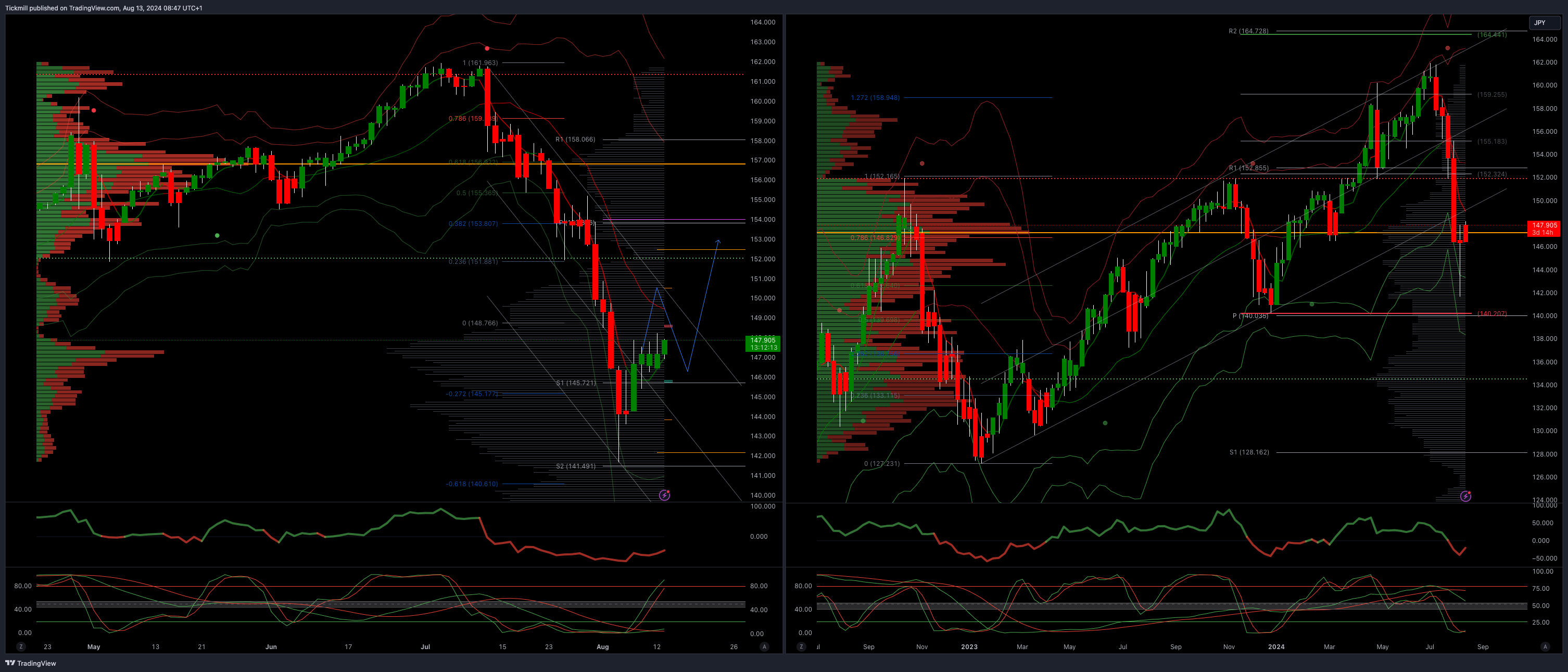

USDJPY Bullish Above Bearish Below 149

Daily VWAP bullish

Weekly VWAP bearish

Above 150 opens 153

Primary support 140

Primary objective is 153

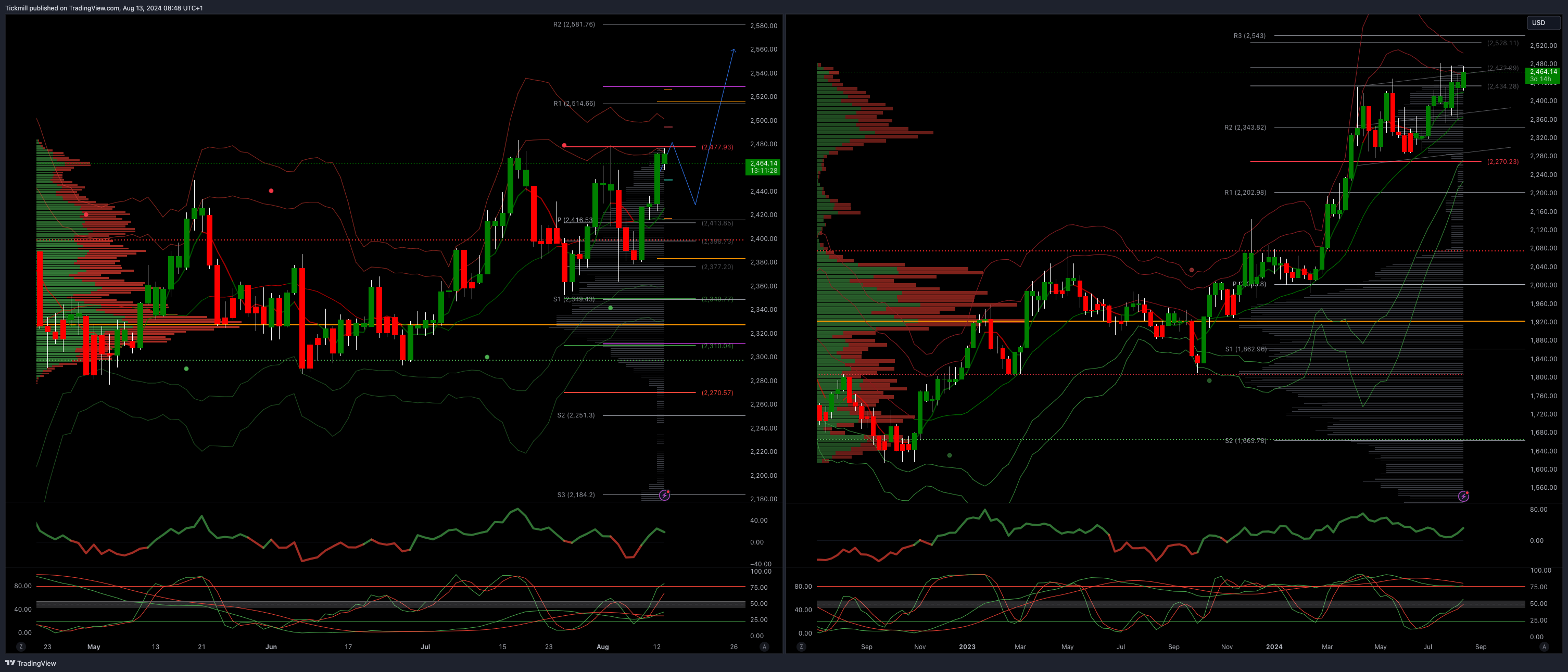

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

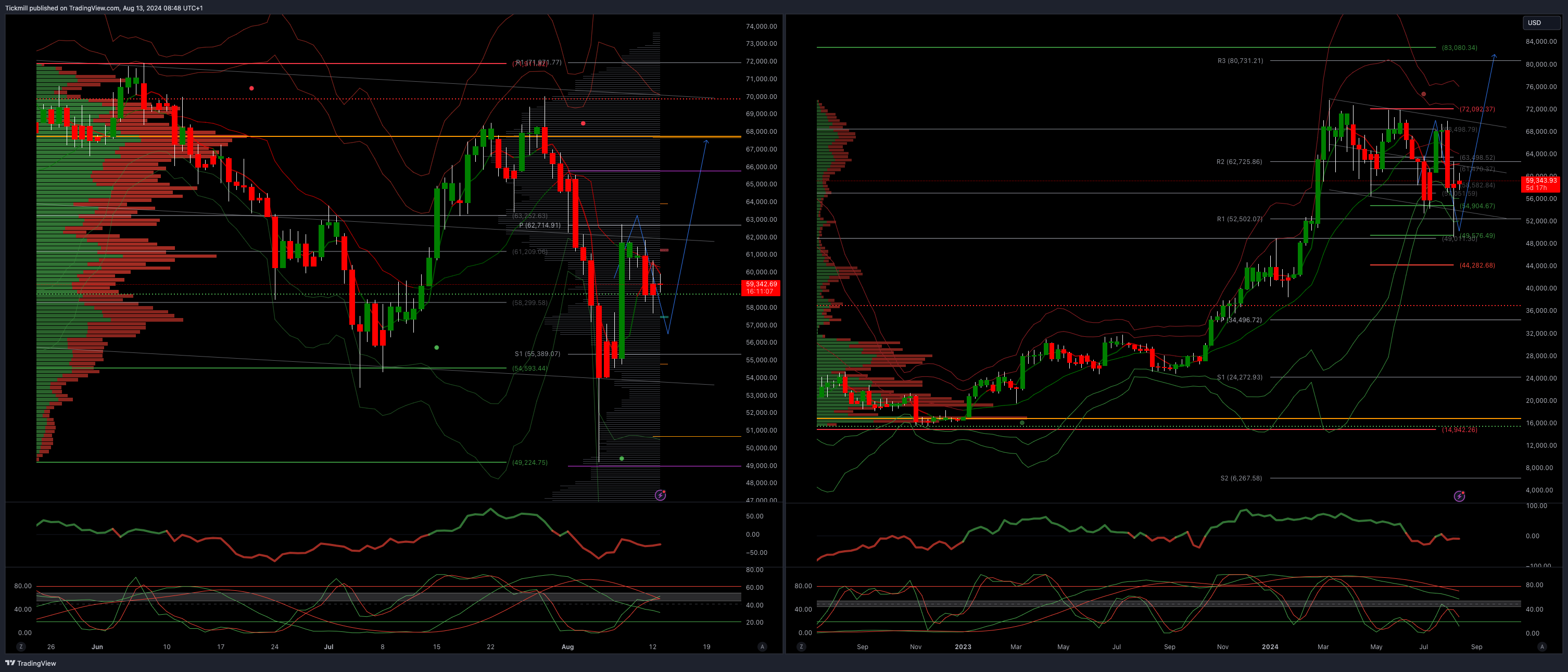

BTCUSD Bullish Above Bearish below 58000

Daily VWAP bearish

Weekly VWAP bearish

Above 61000 opens 68000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!