REAL TIME NEWS

Loading...

FTSE 100 FINISH LINE 2/2/26 The UK's FTSE 100 posted modest gains on Monday as investors shifted their focus to defensive sectors like pharmaceuticals and consumer staples amid a global downturn in energy and metal stocks. The blue-chip index rose 0.8% despite...

FTSE 100 FINISH LINE 2/2/26 The UK's FTSE 100 posted modest gains on Monday as investors shifted their focus to defensive sectors like pharmaceut

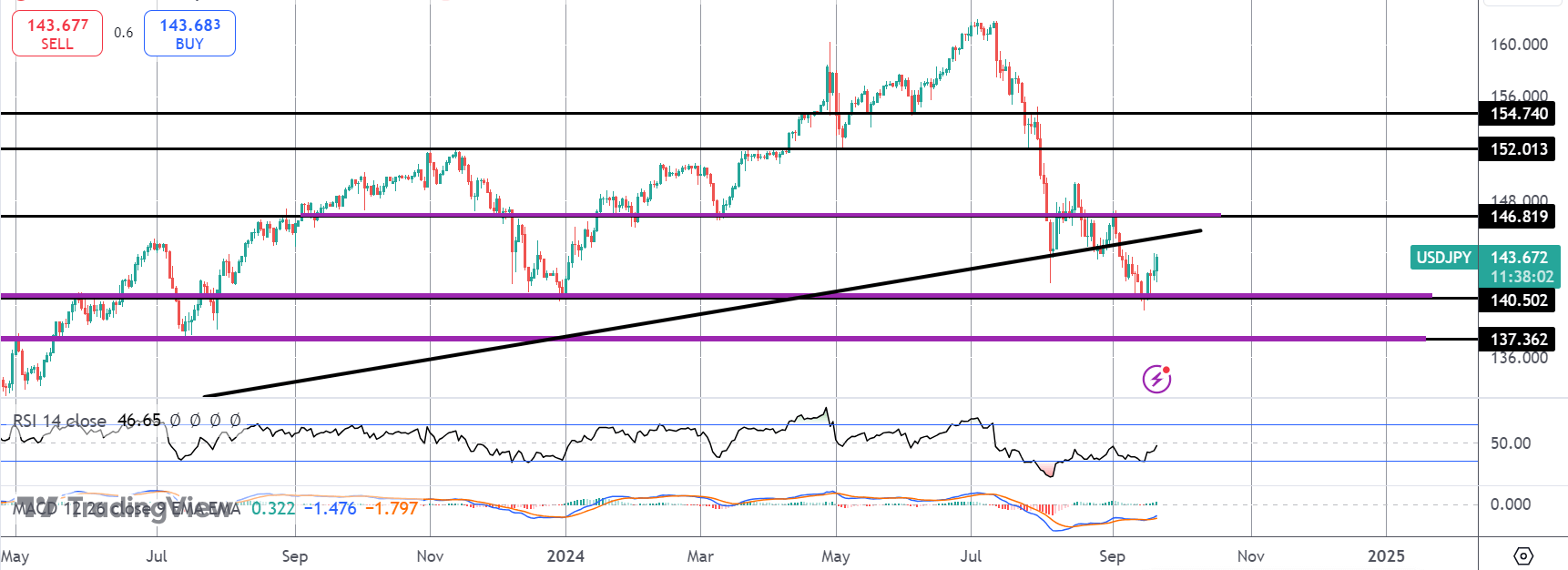

Title USDJPY H4 | Heading towards 50% Fib resistanceType Bearish reversal Preference The price is rising towards the pivot at 155.61, a pullback resistance that aligns with the 50% Fibonacci retracement. A reversal at this level could lead the price toward the 1st ...

Title USDJPY H4 | Heading towards 50% Fib resistanceType Bearish reversal Preference The price is rising towards the pivot at 155.61, a pullback resis

Daily Market Outlook, February 2, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…The dramatic market turnaround on Friday shook assets that had been thriving in January, leading to a sharp sell-off. Gold and silver, which had...

Daily Market Outlook, February 2, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…The dramatic market turnaroun

SP500 Weekly Action Areas & Price Targets: 2/2/26Real-time actionable analysis on futures markets. specific focus on E-mini S&P500. To review this week's analysis, click here!...

SP500 Weekly Action Areas & Price Targets: 2/2/26Real-time actionable analysis on futures markets. specific focus on E-mini S&P500. To review

SP500 LDN TRADING UPDATE 2/2/26***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE******WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***WEEKLY BULL BEAR ZONE 6859/69WEEKLY RANGE RES 7058 SUP 6869FEB OPEX STRADDLE 6726/7154MAR Q...

SP500 LDN TRADING UPDATE 2/2/26***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE******WEEKLY ACTION AREA VIDEO TO FO

What’s driving markets separating “story” from “flow/positioning.”Narrative catalysts (headlines)Warsh news: market blaming it; the author thinks the impact is less about hawkish rates (rates “unmoved”) and more about Fed independence / USD debasement optics.US dat...

What’s driving markets separating “story” from “flow/positioning.”Narrative catalysts (headlines)Warsh news: market blaming it; the author thinks the

Title EURUSD H4 | Bullish bounce setup Type Bullish bounce Preference The price is falling towards the pivot at 1.1801, which is a pullback support that is slightly above the 50% Fibonacci retracement. A bounce from this level could lead the price toward the 1st re...

Title EURUSD H4 | Bullish bounce setup Type Bullish bounce Preference The price is falling towards the pivot at 1.1801, which is a pullback support th

Title XAUUSD H4 | Bullish bounce off overlap support Type Bullish bouncePreference The price is falling towards the pivot at 4,541.80, which is an overlap support that aligns with the 78.6% Fibonacci retracement. A bounce from this level could lead the price toward...

Title XAUUSD H4 | Bullish bounce off overlap support Type Bullish bouncePreference The price is falling towards the pivot at 4,541.80, which is an ove

Title GBPUSD H4 | Potential bearish drop off Type Bearish drop Preference The price has reacted off the pivot at 1.3765, a pullback resistance. A drop from this level could lead the price toward the 1st support at 1.3548, a pullback support that aligns with the 61....

Title GBPUSD H4 | Potential bearish drop off Type Bearish drop Preference The price has reacted off the pivot at 1.3765, a pullback resistance. A drop

VWAP Swing Strategy Weekly/ Jan Monthly UpdateIn this update, we review the alerts and trades from last week, updating performance metrics for that week and the month of January, which only consisted of two weeks of active trading. To review this week's update...

VWAP Swing Strategy Weekly/ Jan Monthly UpdateIn this update, we review the alerts and trades from last week, updating performance metrics for that we

-1726828739.png)

-1726743070.png)